Nowadays, the consumers who like to do online shopping want only one thing, and that is quick & fast transitions. A couple of additional steps or redirects during the checkout process can very quickly convert the customer’s mood from excitement to frustration, and as a result, the rate of cart abandonment increases considerably.

With PayPal’s Expanded Checkout, the issue is resolved to a large extent as the payment process becomes quicker, easier, and more adaptable, and this is a major breakthrough not only for the retail sector but also for travel websites that combine flights, hotels, and transfers.

What Is PayPal’s Expanded Checkout?

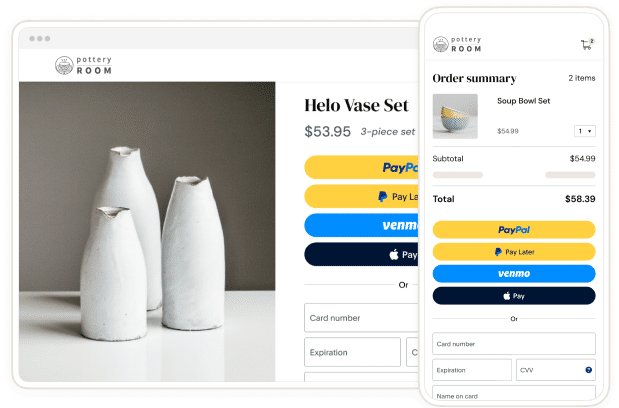

PayPal’s Expanded Checkout consolidates multiple payment methods PayPal, cards, Venmo, Pay Later, and local wallets, into one smooth interface presented directly on a merchant’s site.

That means:

- No redirects to external pages

- Fewer form fields for repeat customers

- Native support for BNPL and localized payment options

- Higher conversion rates due to fewer steps

- Stronger trust because of familiar payment branding

- Global reach through multi-currency and localized options

- Increased average order value by enabling Pay Later and split payments

- Unified payment flow: Presenting all payment options in one place.

- Smarter routing: Showing the most relevant methods by region or device

- One-tap repeat purchases: Faster checkouts for returning customers.

- Buy Now & Pay Later: Increasing conversion and order sizes.

- Cross-border capability: Built-in support for international sales.

- A traveler searches and books a hotel (live data via RateHawk).

- They add a transfer or local experience.

- They complete payment instantly through PayPal’s unified checkout—without redirects or separate payment pages.

- More impulse purchases: Less hesitation when payment is instant.

- Better mobile conversions: Fewer taps and fields on small screens.

- Higher repeat rates: Saved credentials make repurchasing effortless.

- Greater trust: PayPal branding reassures users at the point of payment.

- Orchestrating booking + payment flows: Confirm booking availability via the booking API before finalizing payment capture.

- Idempotency: Use idempotent requests to prevent duplicate bookings during payment retries.

- Tokenization & Security: Tokenize payment data and use a secure token exchange between systems.

- UX continuity: Keep visual harmony of the booking, add-ons, and payment interfaces so that the users are not confused.

- Testing: Confirm the edge cases, partial refunds, failed captures, and timeouts to be able to recover in a calm manner.

In short, it’s a checkout built around user convenience and trust, not extra friction.

Why It Matters for Online Businesses

Checkout is the final gate between browsing and buying. Complex checkout flows are a primary cause of cart abandonment; simplifying that flow can materially increase conversions.

Key business benefits include:

This isn’t just a technical improvement; it’s a direct way to improve revenue by optimizing the end of the purchase funnel.

Key Features That Redefine the Checkout Experience

PayPal’s Expanded Checkout is more than a UI tweak. Important features include:

All these features of PayPal make the buyers’ shopping more effortless.

Why This Matters for Travel Portals—RateHawk & Payment Flow

One interesting case of travel portals is how a single booking can be a combination of various products like flights, hotels, and transfers, where each product is powered by different APIs. As an illustration, numerous travel portals enable a hotel to be searched and booked through the RateHawk API, which offers live hotel search, availability, and reservation functionalities.

When PayPal’s Expanded Checkout is integrated alongside APIs like RateHawk, the user experience becomes genuinely end-to-end:

That tight coupling between booking APIs and a streamlined payment flow reduces errors, prevents abandoned bookings, and increases user trust, especially for higher-value travel purchases where customers expect both accuracy and security.

Contact us Today

How PayPal’s Checkout Changes Consumer Behavior

Frictionless checkout shifts the psychology of buying:

For travel portals, where bookings can be complex and costly, this trust and speed translate directly into completed transactions and fewer abandoned itineraries.

Practical Integration Notes for Developers

To combine booking APIs (like RateHawk) with PayPal’s checkout effectively, developers should consider:

These practices ensure booking integrity while delivering a smooth payment experience.

Reach us Here

Final Thoughts:

PayPal’s Expanded Checkout is more than a faster way to pay; it’s a design pattern for modern commerce: unified, contextual, and trust-based. For the travel platforms that depend on API-driven services such as RateHawk, this checkout model is the one that essentially closes the loop between the process of discovery and that of purchase. The outcome is a simplified customer journey, an increased number of conversions, and a booking experience that is more stable. In case your platform continues the practice of splitting booking and payment between different systems, the integration of a contemporary checkout with booking APIs is a feasible method to raise conversion rates and to have a tangible business impact.